I recently watched a powerful video titled “Wealth Inequality: The Quiet Apocalypse.” It’s honest, emotional, and brutally accurate in describing what it feels like to live in a system that seems to squeeze you harder every year. I found myself nodding along for much of it—but also wanting to widen the lens a little.

Before offering my response, here are five key points I took from the video:

Five Core Points from “Wealth Inequality: The Quiet Apocalypse”

- The system isn’t broken—it’s working as designed. It extracts time and value from most people and consolidates wealth at the top.

- Capital outpaces labor. Referencing Piketty: when the rate of return on capital exceeds growth, wealth concentrates.

- The American Dream is largely a delusion. Doing everything right doesn’t mean you’ll get ahead.

- Wealth inequality creates spiritual and psychological harm. It hollows out people’s sense of identity and worth.

- What we need is a cultural shift—not just policy. Minimalism, rest, and meaning are antidotes to hustle culture and economic extraction.

Here’s my reply, point by point.

1. The system isn’t broken—it’s working as designed

Yes, the system is designed to reward capital—not labor. But that doesn’t mean we need to burn the whole thing down. In fact, we should want capital to outperform labor—because that means more productivity with less effort.

The real problem? Capital is too concentrated.

What if we built systems that allowed more people to own capital? That would mean more people benefiting from productivity gains, without needing to grind themselves into dust. In the U.S., this is more accessible than we sometimes realize. Low-cost investing tools, like Fidelity or Vanguard, allow everyday people to start building wealth—even with modest means.

I wrote about how just $2,000/year for 10 years can grow to over $365,000 by retirement:

👉 The Power of Investing Early

The system does work—as designed. We just need to make sure more people have a stake in it.

2. Capital outpaces labor

Piketty’s point is mathematically true: capital grows faster than wages, and that concentrates wealth. But instead of treating that as a death sentence, let’s treat it like a map.

If labor will always lose, then we need to stop relying on labor alone. We need to become capital owners.

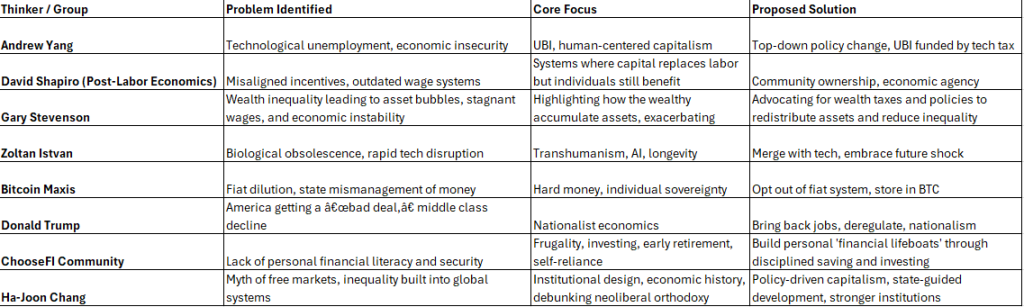

That’s the core of Post-Labor Economics: a future where AI and automation do the work, and human beings benefit from ownership rather than employment. That’s only dystopian if ownership remains exclusive.

I broke this down further here:

👉 Post-Labor Economics – David Shapiro Video Summary

The real answer isn’t to slow capital—it’s to distribute capital.

3. The American Dream is a delusion

We agree: doing everything “right” no longer guarantees success. Degrees, hard work, and even smart money habits don’t always lead to stability.

But here’s the truth: that level of frustration is itself a luxury in global terms. If you’re in the U.S., have internet, clean water, and access to banking—you are already in the global top 10%, maybe even the top 1%.

I say this not to invalidate anyone’s struggle—but to widen the perspective. There are billions of people who would love to have the problems you have. That realization isn’t meant to inspire guilt—it’s meant to highlight opportunity.

You don’t have to “win” the American Dream to live a meaningful life. But if you understand your relative position in the world, you can use it to lift others up while building your own path.

4. Wealth inequality creates spiritual and psychological harm

Yes. When everything becomes transactional, identity collapses into productivity and income. And when we don’t measure up, we blame ourselves.

But here’s the twist: even while critiquing this system, you might still be letting it define you.

There are other ways of living. You don’t need to win the game. You can just stop playing—and focus instead on living intentionally, giving what you can, and creating meaning through service or simplicity.

Some books that shaped my thinking:

- Enough: Why the World’s Poorest Starve in an Age of Plenty – on the solvable nature of global hunger

- The Life You Can Save – on how modest giving can save real lives

- Strangers Drowning – on people who live lives of radical altruism

Even if just 5% of your life is dedicated to helping others, that’s enough. That’s opting out of the culture in a way that matters.

5. We need a cultural shift—not just policy

Yes. A shift away from hustle culture, productivity obsession, and materialism is overdue. Minimalism, rest, and meaning are powerful forms of resistance.

But there’s another layer: you don’t just have to escape the culture—you can help reshape it.

That might mean:

- Raising your kids with different values

- Giving consistently, even in small amounts

- Choosing a simple life so others can simply live

You don’t need to be an influencer or a billionaire to change the culture. You just need to stop waiting for permission—and start living by a better scorecard.

Opting out is good. But opting into something better is even stronger.

Final Thoughts

Wealth Inequality: The Quiet Apocalypse is a powerful wake-up call. But let’s not stop at diagnosis. Let’s ask: what comes next?

You don’t need to be rich to make a difference. You don’t need to have all the answers to start living a better one. And even in a rigged game, you can still choose your own values.

In a collapsing world, the most radical thing you can do is refuse to collapse with it.

And if you’re someone with a platform—as the video’s creator clearly is, with 80,000+ subscribers—then that gives you not just a voice, but a real opportunity. You can lead. You can educate. You can help people see a way forward.

Not everyone has that kind of reach. So if you do, I hope you use it.

If you want to learn more about effective giving, post-labor economics, or investing with purpose, browse around MyWheelLife.com.