Intro – Why can’t Americans find good jobs anymore?

Because the U.S. dollar’s role as the world’s reserve currency lets us import everything without producing anything.

Fiat money didn’t just change our economy—it hollowed it out.

This article explains how we got here—and why only a return to hard money, like Bitcoin, can bring us back.

There’s a sentence I keep coming back to:

Without fiat, we’d have to export goods to earn gold or foreign currency before we could import.

Quick note: “Fiat” money just means paper money that isn’t backed by anything tangible like gold or silver. Its value comes entirely from government decree (“fiat” is Latin for “let it be done”)—and trust.

That’s it. That’s the whole game.

Donald Trump spent years hammering America’s trade deficit, accusing China of taking advantage of us and blaming past politicians for “bad deals.” But the truth is deeper—and more systemic.

The trade deficit isn’t just a negotiating failure. It’s a structural requirement of the global dollar system.

Since the 1970s, the U.S. has run chronic trade deficits not because we’re dumb—but because we have to. That’s how the world gets its dollars. It’s the price of running the global reserve currency.

Fiat money—and specifically, the U.S. dollar’s role as global reserve—didn’t just change how we buy and sell. It rewired the entire global economy. It made it profitable to consume without producing, and to outsource labor while importing goods with nothing more than printed IOUs.

Let’s break that down.

📜 A Brief History of the Cheat Code

After World War II, the U.S. dollar became the centerpiece of the global financial system through the Bretton Woods Agreement. Other countries pegged their currencies to the dollar, and the dollar was pegged to gold at $35/oz. Global trust was strong—because dollars were redeemable for something real.

But by the late 1960s, the system was already cracking.

The U.S. was printing more dollars than it had gold to back, funding both the Vietnam War and LBJ’s Great Society programs. Foreign nations started to notice. The promise of gold convertibility was still on paper, but the gold simply wasn’t there to cover all the dollars in circulation.

Then came the bluff-calling moment: France sent a warship to New York Harbor in 1971 to collect its gold. The U.S. honored the request—but it was a wake-up call. If one country could demand gold, others would follow—and the U.S. didn’t have enough gold left to fulfill those redemptions.

Rather than continue the outflow—and risk total collapse of the system—President Nixon closed the gold window, ending the dollar’s convertibility to gold and defaulting on the original Bretton Woods promise. He called it “temporary,” but we’re still living with the consequences.

The U.S. had just rugged the global economy—but there was no better option available. All other currencies were fiat too.

And so, by default—not by merit—the dollar remained the foundation of global trade.

🛢️ The Petrodollar Patch

To maintain global demand for the dollar, the U.S. struck a 1974 deal with Saudi Arabia:

- The Saudis would price oil only in dollars,

- And the U.S. would provide military protection.

This created the petrodollar system, locking in global demand for dollars—because energy runs the world. Every country that wanted oil had to first acquire dollars.

That meant: even without gold, the dollar was still backed—by oil, debt, and military force.

This gave the U.S. a unique superpower:

- Print money (or sell Treasuries),

- Ship it overseas,

- And receive real goods, labor, and resources in return.

No other nation could do this. And no other empire in history ever got away with it for so long.

🏭 The Fallout: Jobs Go Offshore, But Dollars Still Flow

Because the world kept accepting dollars, American companies could:

- Shut down U.S. factories,

- Hire cheaper labor abroad,

- Import those same goods back to the U.S.,

- And sell them to consumers who were buying with borrowed or printed money.

The fiat system didn’t make foreign workers cheaper, but it made it possible to use them without consequences.

We stopped needing to earn our imports by making things. We could just finance everything with paper and debt. Capital loved it. Wall Street loved it. Politicians loved it.

But working people? Not so much.

From Janesville to Youngstown, from Flint to the Bronx, the outcome was the same: a slow, grinding hollowing-out of America’s industrial base and middle class.

🏦 Makers and Takers: How Finance Replaced Work

In Makers and Takers, journalist Rana Foroohar lays out how U.S. corporations gradually stopped investing in workers, R&D, and physical capital—and instead prioritized stock buybacks, dividends, and debt-fueled growth.

But here’s the uncomfortable truth:

Many of those companies had to play that game—or risk being eaten alive.

In a fiat system with low interest rates, abundant capital, and massive global competition:

- Shareholder pressure rewards short-term profit over long-term investment.

- Stock buybacks boost prices faster than hiring or training workers.

- Outsourcing and financial engineering became necessary survival tools—not just greed.

This wasn’t just a few bad CEOs. It was a system-wide shift in incentives.

The rise of finance wasn’t a deviation—it was an adaptation.

🤖 You Can’t Skill Your Way Out of This

Today, people are told to just “learn to code” or “work harder.” But what they’re really up against is a global fiat machine that rewards capital over labor, and extraction over production.

That’s why:

- Degrees don’t guarantee jobs,

- Effort doesn’t guarantee stability,

- And “just working harder” feels like treading water.

It’s not that Americans don’t want to work. It’s that the system no longer rewards domestic labor—because it doesn’t need to.

🧱 What Comes Next?

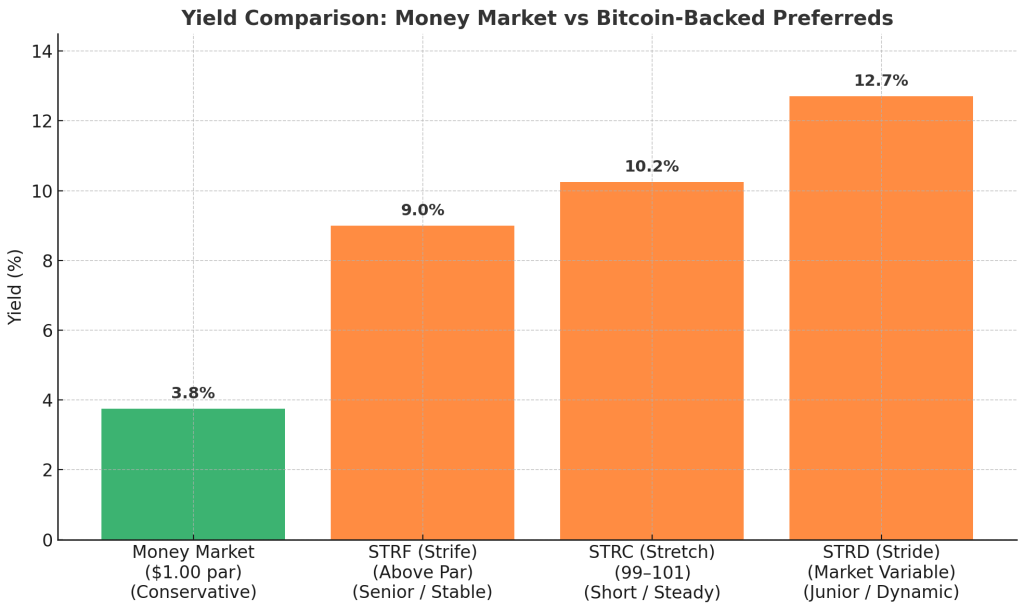

The world is starting to wake up. Countries are buying gold. Some are experimenting with Bitcoin. Others are trying to de-dollarize trade altogether. Trust in the U.S. dollar isn’t infinite—and neither is the empire it props up.

The dollar still works—not because it’s sound, but because there hasn’t been a better option. Yet.

But every empire that runs on paper eventually runs out of trust. And when that happens, the real cost of all those “free” imports comes due.

₿ A Hard Money Future: Why Bitcoin Matters

The only real way to end this game is to remove the cheat code: fiat money itself.

A return to hard money—like Bitcoin—could force the system to reorient around real productivity, long-term investment, and sustainable value creation.

Without the ability to endlessly paper over deficits, businesses would once again have to:

- Build resilient supply chains

- Invest in their workers

- Serve customers over shareholders

- Plan for decades, not quarters

Bitcoin doesn’t just offer escape—it offers discipline. It turns off the short-term game and invites long-term thinking back into the economy.

💬 Closing Thought

Fiat gave us the illusion that we could consume without producing.

But in the long run, reality has a way of settling the bill.

Maybe it’s time we stopped running the tab—and started building again.