Money market funds have quietly become a $7.7 trillion behemoth. They’re the go-to “safe yield” for investors and savers alike. But with the Federal Reserve now in an easing cycle, those yields — currently around 3.5%–4% — are headed lower.

That’s where Strategy’s Bitcoin-backed perpetual preferreds come in. While most people know Strategy (MSTR) as the largest corporate holder of Bitcoin, fewer realize that it has built a full yield curve of preferred instruments, each engineered for different investors.

Where These Instruments Sit in the Capital Stack

Most senior → Debt (convertible notes) → STRF (Strife) → STRC (Stretch) → STRK (Strike) → STRD (Stride) → Common (MSTR) → most junior / volatile.

The Rationale: Building a Bitcoin Yield Curve

- STRF (Strife): Senior, cumulative, fixed dividend, long-duration. Currently yielding about 9%.

- STRC (Stretch): Senior to STRD and STRK. Variable monthly dividend, engineered to trade around $99–$101, currently yielding about 10.25%.

- STRK (Strike): Convertible hybrid with both dividend and equity-conversion features. Not my focus here, but it’s an important part of the structure.

- STRD (Stride): Junior high-yield, fixed 10% dividend, currently yielding about 12.7% due to market pricing in more perceived risk. Functionally similar to STRF, except dividends are non-cumulative (can technically be skipped). That said, I believe skipping would be highly unlikely, as it would damage trust and Strategy’s ability to raise future capital. Dividends are paid quarterly.

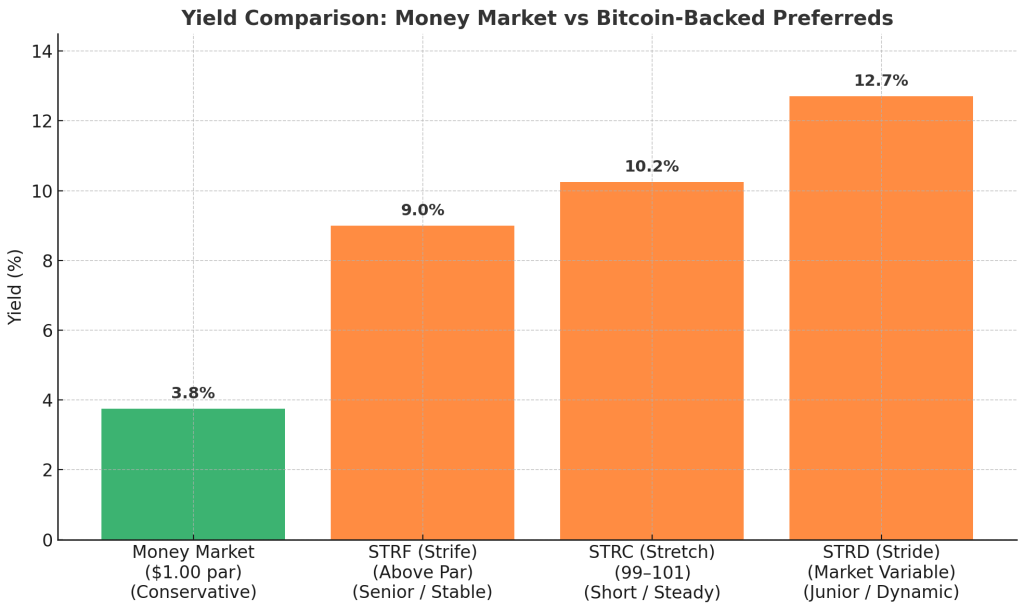

Visualizing the Yields

Here’s how these instruments compare against traditional money markets:

- Money Market (green): conservative baseline at ~3.5–4%.

- STRF (orange): senior, stable preferred with ~9%.

- STRC (orange): short, steady instrument at ~10.25%, engineered to trade near $100.

- STRD (orange): dynamic junior instrument at ~12.7%.

Why I Prefer STRC and STRD

I’m drawn most to STRC and STRD.

- STRC is designed to be the least volatile of the group, with a monthly payout and mechanisms (ATM issuance, variable rate, call option) that help stabilize its price.

- STRD is the high-yield gear, juiced by its junior position in the stack. While the market demands extra yield for perceived risk, I personally think that risk is overstated given Strategy’s Bitcoin reserves and incentives to maintain dividend trust.

Together, they cover two ends of the spectrum: steady monthly yield vs. higher-octane quarterly yield.

A Practical Emergency Fund Example

Suppose you have a $10,000 emergency fund.

- All in Money Market: $10,000 × 4% ≈ $400/year.

- Blend with STRC: Keep $7,500 in money markets (=$300/year) and put $2,500 into STRC (=$256/year).

- Total = $556/year — a 39% boost without overcommitting.

- Total = $556/year — a 39% boost without overcommitting.

I wouldn’t put my entire emergency fund into a new instrument like STRC — safety and liquidity should come first. But even a modest allocation can noticeably lift your yield while still keeping most reserves conservative.

Closing Thought

Strategy is essentially pioneering a new financial system built on Bitcoin collateral. If they can consistently pay these dividends — even through Bitcoin downturns — it would be revolutionary. It would prove that Bitcoin isn’t just “digital gold,” but the foundation for a new class of yield-bearing, creditworthy instruments.

Here are 2 videos of when STRC and STRD were initially offered. They offer a lot of information about how these work.

Strategy’s Stride STRD Perpetual Preferred Stock IPO Backed by Bitcoin | Michael Saylor and Phong Le

Strategy’s Stretch STRC Perpetual Preferred Stock IPO Backed by Bitcoin | Michael Saylor & Phong Le