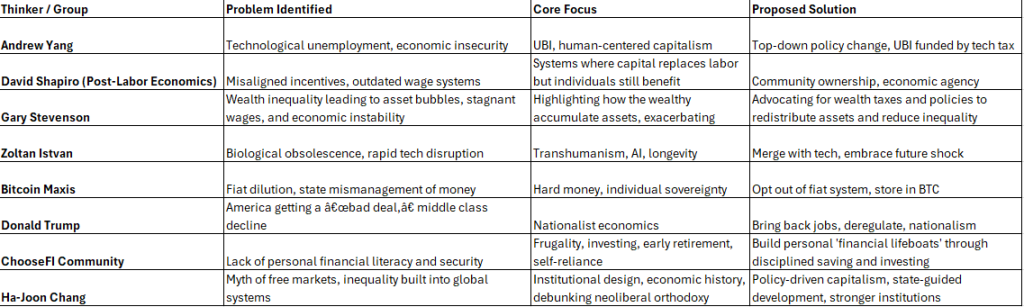

I generated the above table using ChatGPT. I have been invovled in all of these communities that are swirling around the same ideas. I wish I could get them to work together.

ChatGPT also generated the below. It’s not perfect but I wanted to publish it because I want to.

- offer it to the world

- open for critique and improvements.

The Earned World Manifesto

A Declaration for Builders, Not Rent-Seekers

1. The Problem We See

The current system extracts more than it empowers.

It rewards proximity to power, not creation of value.

It builds systems that entrench dependency, then calls that stability.

We see:

- Productivity rising — but wages stagnating

- Knowledge abundant — but credentials gatekept

- Labor outsourced — but profit hoarded

- Currency inflated — but savings eroded

- Talent global — but opportunity gated

- Work automated — but ownership concentrated

This is not an accident.

The rules are rigged — and the game is extraction.

2. What We Believe

🧱 Agency Is Non-Negotiable

Each individual has the right — and the responsibility — to direct their life.

Freedom is not given. It is constructed.

📈 Value Should Flow to the Builder

The person who creates, fixes, or risks should own the upside.

Rent-seeking is a tax on the capable.

🧠 Education Must Be Sovereign

Learning is abundant. Gatekeeping it is theft.

We reject the credential treadmill in favor of demonstrated skill.

💰 Money Must Be Earned and Preserved

Currency debasement is economic theft.

Savings must store effort, not melt it.

🔐 Ownership Is the Foundation

He who owns the tool, the platform, the protocol — holds the power.

We choose ownership over permission.

3. What We Support

This is not a utopia. It is a direction.

We support:

- 🔸 Individuals achieving financial independence through disciplined action

- 🔸 Workers becoming owners, not just operators

- 🔸 Monetary systems (like Bitcoin) that cannot be corrupted

- 🔸 Skill-first pathways over debt-fueled credentials

- 🔸 Systems that reward contribution, not compliance

- 🔸 Local or global opt-out zones where new rules can be tested

We reject:

- Coerced redistribution

- Forced altruism

- Dependence disguised as security

4. Our Two-Stage Strategy

🛶 Stage 1: Build your lifeboat.

Earn freedom through action.

Reduce expenses, save in hard assets, develop durable skills, and reclaim your time.

🏛️ Stage 2: Rebuild the harbor.

Use your freedom to build systems that don’t demand sacrifice to survive.

Not as charity — but as infrastructure for agency.

5. Join Us

We are the builders. The earners. The ones who won’t rent our future.

We will:

- Speak plainly about value and power

- Share tools, not just tweets

- Reward proof-of-work, not status

- Create systems where sovereignty scales

If you’re tired of extraction,

If you still believe in ownership,

If you’re ready to build —

Welcome to the Earned World.

As I was generating the Manifesto, I had a lot of conversation with ChatGPT. Below was a powerful statement it had.

“The current system extracts more than it empowers.”

This means that the rewards of the modern economy are disproportionately claimed by systems, institutions, and owners — not by the individuals doing the work or taking the risk. The value flows upward, while the burden flows downward.

Here’s what that looks like across different dimensions:

💼 In Work

- Wages have stagnated while productivity and corporate profits rise.

- Most workers trade time for money with little long-term upside (no ownership, equity, or growth path).

- Gig work and contract labor shift costs (insurance, risk, taxes) to the individual while stripping stability.

Extraction: Time, energy, creativity — taken for a wage that doesn’t keep up with cost of living.

Empowerment: Would mean building ownership, autonomy, or long-term equity from your work.

💸 In Money

- Fiat currency loses purchasing power over time (inflation), punishing savers and wage earners.

- Asset inflation (stocks, real estate) benefits those who already hold wealth — not those trying to build it.

- Central banks and governments distort money supply in ways individuals cannot control or escape.

Extraction: Your savings melt while those close to the money printer get richer.

Empowerment: Would mean access to stable, sovereign, permissionless money, Bitcoin.

🏥 In Healthcare

- Healthcare is tied to employment — meaning you’re not truly free to leave your job.

- Insurance costs rise faster than wages; many avoid treatment due to fear of bills.

Extraction: Your health and security are used to bind you to jobs and debt.

Empowerment: Would mean decoupling basic needs from corporate control.

🏠 In Housing

- Real estate is increasingly used as an investment vehicle, not a place to live.

- Young people are priced out of ownership, forced into permanent renting.

Extraction: Rent drains wealth every month with no asset built.

Empowerment: Would mean pathways to ownership, equity, or cooperative housing.

🎓 In Education

- Education costs have exploded, leading to decades-long student debt burdens.

- The credential economy keeps people in a treadmill of debt just to be “qualified.”

Extraction: You pay to enter the game, and the game changes by the time you finish.

Empowerment: Would mean low-cost, high-agency pathways to skill and livelihood.

🤖 In Technology

- Tech companies extract your attention, data, and time to sell to advertisers.

- Users create content and community, but ownership and profits go to platforms.

Extraction: You are the product.

Empowerment: Would mean open platforms, data sovereignty, and user-owned networks.

🔁 Why This Matters

When a system extracts more than it empowers, it means:

- The average person gets poorer in power, even if they get richer in consumption.

- Stability, dignity, and control are replaced with dependency and precarity.

- People become functionaries, not free agents.

Stagnation in the U.S. and suppression in Mexico are two symptoms of the same disease:

A system where capital moves freely, but labor and ownership do not.

Personal sovereignty is the prerequisite for systemic sovereignty.

Entrepreneurship without savings is economic quicksand.

I think there are solutions to a lot of these propblems. But this is teh start of framing for myself to think more about solutions.

I encourage everyone in the communities I identified to read this as well as consider how they coudl work to make their own lives better as well as make the system better.

I want to highlight the 2 step process.

🛶 Stage 1: Build your lifeboat.

Earn freedom through action.

Reduce expenses, save in hard assets, develop durable skills, and reclaim your time.

🏛️ Stage 2: Rebuild the harbor.

Use your freedom to build systems that don’t demand sacrifice to survive.

Not as charity — but as infrastructure for agency.

While I believe everyone is capable of building their lifeboat, it is certainly harder for some than others.

Please comment with any thoughts you have to update this.

Please feed this into AI and discuss with it how you might make chagnes to or improve it.

Here are a few resources I referenced when thinking about this.

Gold, Silver, Debt To GDP, Wealth Preservation

The Idea of Bitcoin Needs to Succeed, Even if Bitcoin Fails

23 Things They Don’t Tell You About Capitalism -Ha-Joon Chang