(inspired by this episode of Bitcoin for Millennials)

Big idea: Spain found a mountain of silver in Bolivia, spent like crazy, stopped building real industries—and the bill came due. The same thing is happening today, just with money printers instead of mines.

1) The mountain

In 1545, Spanish explorers struck the richest silver deposit in history: Cerro Rico, “the rich mountain,” in what’s now Bolivia.

A city called Potosí exploded out of the rock. At its height, it was larger than London or Paris.

For two centuries, roughly two-thirds of the world’s silver came from that one mountain. Spain looked unstoppable.

2) Easy money, hard problems

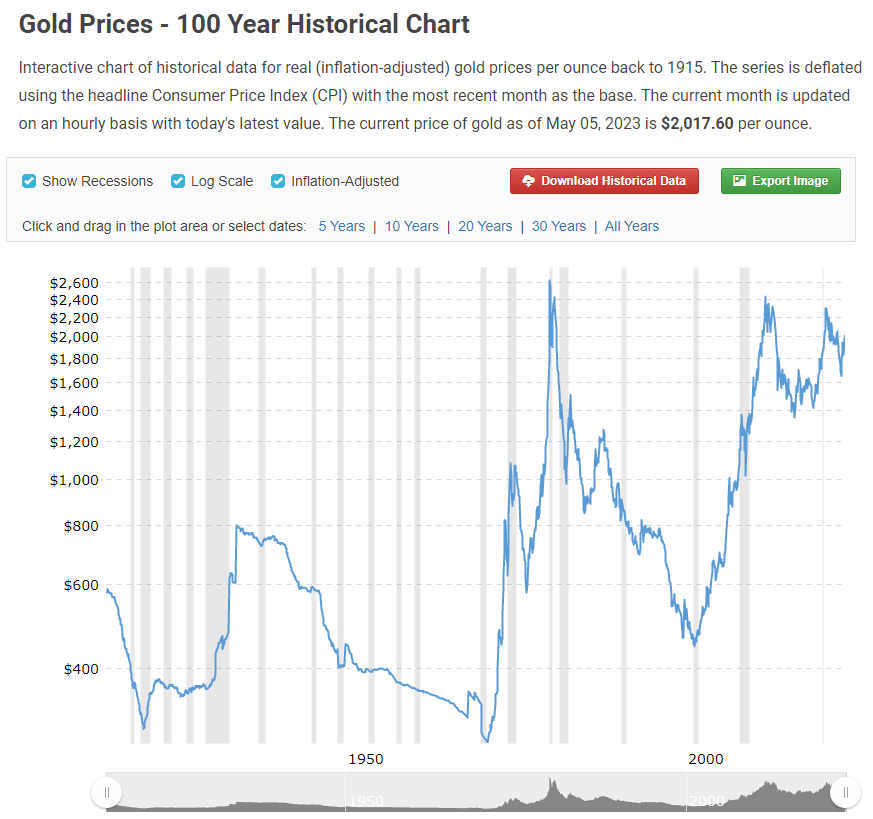

So much silver poured into Europe that prices began rising year after year.

For nearly a thousand years, prices in Europe had been flat. Then suddenly, everything—from bread to rent—started costing more.

Historians call it the Price Revolution.

Spain thought it was getting richer. In reality, its silver was just buying less and less.

3) The addiction loop

Spain borrowed against future silver shipments, funded endless wars, and built palaces to show off its power.

Sound familiar? Borrowing against your future is exactly what modern governments do when they run deficits every single year—financing today’s comfort with tomorrow’s labor and taxes.

And those “endless wars”? Spain fought them across Europe. The U.S. fights them across the globe. Different century, same playbook.

4) “Free” silver, “free” money

The silver was basically free to Spain—mined with forced labor that cost almost nothing.

That “free” flow of money metal fueled reckless spending and inflation.

Today, printing money is even freer. No mines, no ships, no workers—just a digital entry at the central bank.

But the result is the same: more money chasing the same goods, rising prices, and wealth concentrating in financial assets instead of productive work.

5) The wage spiral

When silver poured into Spain, mining and trade paid far more than farming or manufacturing.

Workers chased the high wages, and everyone else demanded raises to keep up.

That wage inflation pushed up local costs across the board.

It soon became cheaper to buy foreign goods than to make them at home.

English and Dutch craftsmen could undersell Spanish products even after shipping them across the sea.

Local factories and farms couldn’t compete. Spain’s economy drifted from production to consumption—spending instead of building.

You can see the same thing happening today.

Money printing and easy credit inflate salaries in finance, tech, and government while driving up housing, energy, and labor costs everywhere else.

Manufacturing can’t keep up, so we import the difference.

The result? A strong currency, cheap goods, and a shrinking middle class.

6) The next chapter — Japan

What if the next Spain isn’t America yet—but Japan?

As this interview with macro analyst Roberto Rios explains, Japan is further down the same path:

zero interest rates, quantitative easing, and government debt so large that the central bank must choose between saving its currency or saving its bond market.

For decades, Japan has printed money to prop up its financial system, even buying stocks outright to keep prices from falling.

That free liquidity created an illusion of stability—until inflation returned and the yen began collapsing.

Now Japan faces the impossible choice every over-leveraged empire eventually faces:

protect the currency and crash the system, or print the money and destroy the currency.

It’s the same dilemma America is approaching, just delayed by our global reserve-currency privilege.

The “free silver” of the 1500s became “free paper” in the 1900s and “free digital dollars” in the 2000s. The pattern never changed—only the technology did.

7) The simple lesson

Resources aren’t wealth. Printing money isn’t wealth. Making things is wealth.

When prosperity feels “free,” it’s usually borrowed from the future.

8) Today’s echo

Easy credit. Quantitative easing. Deficit spending.

Each promises painless prosperity—more liquidity, more growth, no trade-offs.

But it’s the same story Spain wrote 500 years ago: short-term abundance, long-term decay.

Spain’s “free” silver built an empire that rotted from within.

Japan’s “free” money is imploding quietly.

And America’s “free” dollar is next in line—just with better branding and digital ink instead of metal.

9) Bitcoin and the Dollar Endgame

What if Japan’s collapsing bond market isn’t just a regional crisis but a preview of America’s financial future?

In the Bitcoin for Millennials episode, host Bram talks with macro analyst Roberto Rios (“Peruvian Bool”), who has been tracking this “dollar endgame” for years.

While most people fixate on Bitcoin’s short-term price swings, Rios zooms out to the structural problem: every central bank is trapped between saving its currency or saving its bond market. Japan is simply the first to hit the wall.

He calls this dynamic financial gravity—the idea that once debt and money creation expand far enough, gravity pulls everything toward a neutral asset that can’t be printed.

Rios’s core argument:

- The global monetary system has reached a point where debt can never shrink; it can only be monetized.

- Central banks will print until confidence breaks.

- When trust in both sides of the fiat balance sheet—bonds and currencies—collapses, capital will flee into something outside the system entirely.

That’s where Bitcoin enters the picture.

While central banks and institutions still view gold as the “neutral” reserve, Rios argues Bitcoin is the superior version of gold:

- Fixed supply, instantly verifiable, infinitely divisible.

- Borderless and digital—no vaults, shipping, or intermediaries.

- Immune to political capture or forced demand (“fiat” in the literal let-there-be sense).

As he puts it, the Japanese bond crisis could actually trigger the biggest Bitcoin bull run ever.

Once Japan’s carry trade unwinds and the yen weakens further, global liquidity shocks will push central banks to print again—reviving the same inflation loop that began with Spain’s silver.

Each cycle of monetary rescue drives more people to seek an exit from the system itself.

From silver to paper to code:

Spain’s “free” silver created Europe’s first inflation.

Japan’s “free” money is collapsing under its own weight.

Bitcoin is the gravity well everything eventually falls into.