The Truth heard one time sounds stranger than a lie heard a thousand times.

The truth is, inflation is caused by the government printing money. There are only so many goods that are possible to be produced by the limited amount of resources in the economy. An infinite amount of dollars cannot create more goods. More money only causes the price of the existing goods to increase as there is more money chasing the same amount of goods.

This is best described in a short book “Economics in One Lesson -Henry Hazlitt”.

This is what happens every time the government increases the money supply. This happens everyday.

We have been in this system since everyone alive was born so it seems like it should be the natural system, but it is not.

Ask a fish to describe air and they’d be confused because they are surrounded by water. We are surrounded by fiat currency so we don’t recognize a good sound money when we are exposed to it.

We don’t need money distributed by the government. Money is an IOU. Money is a medium of exchange that people accept to pay for goods and services, and to repay loans. It’s a commodity that’s widely accepted, holds its value over time, and can be easily translated into prices. Money is the main measure of wealth, and it circulates between people and countries to facilitate trade.

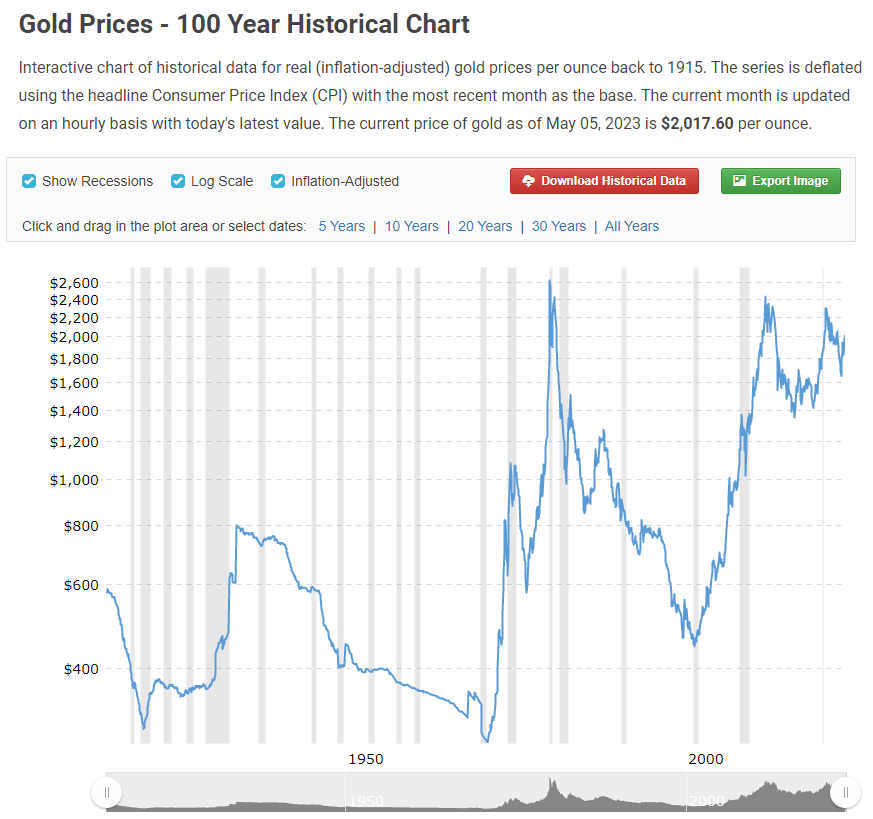

Many things have been money over history, shells, gold, silver, copper, stones. Many of these have not been issued by governments. Fiat currency, money by decree, is a recent development. It inherently has no value. It only has value due to a fluke of history. Until 1971 USD was technically backed by gold. You were supposed to be able to trade in dollars for Gold. But that link was broken in 1933 by Executive order 6102 for individuals in the USA and in 1971 for any countries that wanted to exchange their USD for gold. Both were only supposed to be for a short time and both ended up being permanent, so far.

Another truth is the Government takes value that you have accrued by printing new money. This would be much easier to recognize if the world consisted of 3 people and you each had $100 for a total of $300, but then 1 of the 3 people had the ability to create new money. If the 2 people wanted to buy something and they had $100 total each to bid on that thing but the 3rd person was able to create $500 out of thin air and bid against them the 2 people wouldn’t let that happen. They would recognize that the $500 wasn’t really as valuable as the original $100 that each person had because the individual had just written $500 on a piece of paper and said it had value. This is counterfeiting! Creating new money is illegal for individuals, but the government does it everyday. Why is that ok? This is the same for many governments in history. Governments always default to stealing value from the governed by printing new money.

Why do we put up with this? We all have 1,000 different priorities in our lives. We have to take care of our kids, we have to take care of our parents, we have to take care of ourselves! We want to take a trip. We want to build a house. We want to take a vacation. We want to buy a car. We want to go out to eat or we have some other project we want to dedicate time to. In the USA inflation has been relatively low for many years so while we lose about 3% of the value we create each year, we just deal with it.

But many places have experienced high inflation both recently and over time. Argentina has recently had 100% inflation for multiple years in a row. There is nothing inherently different from the operation of the Argentina economy and central bank from the USA central bank. Turkey, Germany, Zimbabwe, Sudan, they have all experienced hyperinflation at various times.

Physical money is just a replacement for an IOU. An IOU works between 2 individuals. But when you start accounting for goods and services delivered across continents between Billions of people an IOU doesn’t work. That is why IOU’s have been abstracted to Dollars or other currencies.

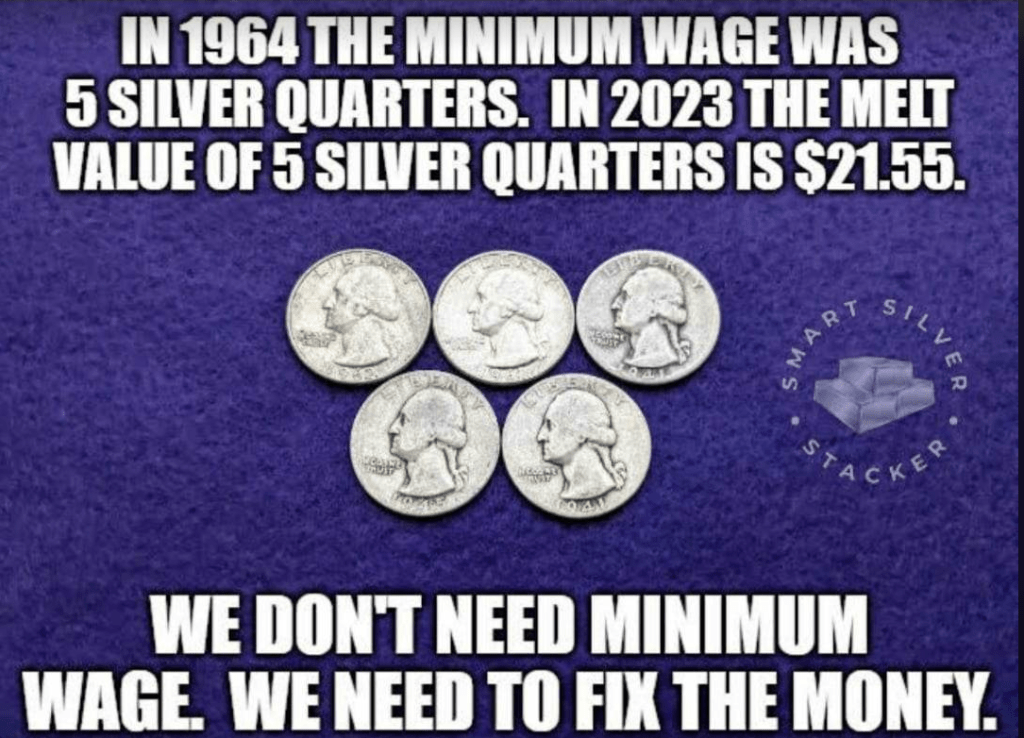

But IOU’s between individuals don’t lose value. If someone does 1 hour of work for you you owe them 1 hour of work back. But if someone does 1 hour of work for you and you pay them $15 and then in a year they want you to do 1 hour of work for them, you will likely charge them $16 due to inflation. Why is this? It is because the accounting system, US Dollars, is broken! They dollars don’t hold value across time.

This is because the government prints more dollars everyday. Every time the government prints a new dollar, every existing dollar loses value.

The only way to fix this is an accounting system that has a fixed amount of units. That is what Bitcoin provides. There are only 21 million Bitcoin available. Each bitcoin can be broken down to 100 million satoshis.

The only reason the price bitcoin is changing today is due to supply and demand for Bitcoin. But you need to look past the present day and envision the future. The future is where bitcoin has been fully adopted by everyone in the world who wants a sound money. In this future the value of all the bitcoin in existence will measure all the goods in the world. As the amount of goods grows with world productivity by about 3% a year the value of bitcoin will continue to grow at the same rate. There won’t be huge swings because there won’t be people speculating on the future price of Bitcoin. It’s price is just a measurement of the good in the world. And since there are 21 million bitcoin, a fixed amount, there is no devaluation of the Bitcoin because more new Bitcoin are not made.

This is the fundamental idea and reason for Bitcoin. It is not a stock or a company. It is a ledger that measures value of things. It can’t be debased like existing USD ledgers.

If you understand this problem, the government stealing value from you via money printing, the solution of Bitcoin appears obvious.

The only question is, does Bitcoin actually solve this problem by being a fixed amount and will the system continue to function as it does today? If it continues to function as it does today, it should continue to gain value. If something comes along and changes how they Bitcoin system works then it’s possible that it could not function as described.

Currently, that would be an “unknown unknown”. There is no obvious thing that would cause Bitcoin to fail. But I always leave a possibility for something to happen that I don’t anticipate in any situation.

Because Bitcoin seems to fix the problems with USD and other fiat currencies (Euros, Yen, Yuan, etc) I believe we should support it’s continued development. That is why I try to educate individuals on the problem that Bitcoin fixes, like with this article.

If you have any questions I’d be more than happy to discuss Bitcoin with you. Please comment or get in touch!