In theory, the ChooseFI and Bitcoin communities should be natural allies. Both value independence, long-term thinking, and building a future that’s not dependent on the whims of politicians or corporations. But in practice, there’s an odd divide: the ChooseFI crowd leans hard into index funds and conventional investing, while Bitcoiners are laser-focused on fixing the money itself.

As someone who walks between both worlds, I think it’s time to bridge this gap.

The ChooseFI Perspective: Smart, but Incomplete

The Financial Independence (FI) movement is one of the best ideas to come out of the last 20 years. It’s a rejection of consumerism and dependence on a 9–5 job. It promotes saving, intentionality, and investing in low-cost index funds to build wealth over time.

But here’s where it falls short: the movement assumes the system is stable enough to invest in indefinitely.

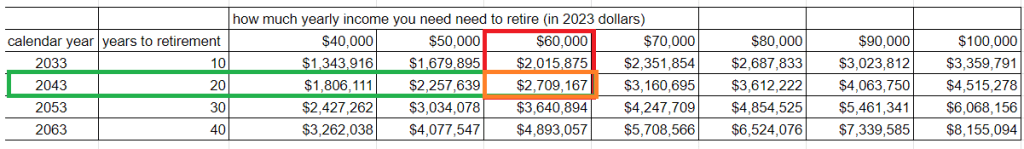

ChooseFI thinkers often acknowledge that inflation erodes purchasing power. That’s why they invest. But they rarely ask why inflation exists or what kind of inflation we’re talking about. They trust the market to keep delivering 7% annual returns because, historically, that’s what it’s done. It’s a comforting narrative—but it’s built on the assumption that the dollar is sound money. It isn’t.

The Bitcoiner’s View: Start With the Root Cause

Bitcoiners take the opposite approach. They start by asking: What if the money itself is broken?

If money is supposed to store value over time and across space, then fiat currency fails that test. Central banks manipulate interest rates and print trillions to bail out markets. This isn’t capitalism—it’s financial engineering.

Bitcoiners understand that if the base layer of the economic system is corrupted, then all the “smart investing strategies” built on top of it are sitting on shaky ground. They argue that if we had sound money—money that couldn’t be debased—then saving would be investing. You wouldn’t have to chase yield to stay ahead of inflation.

In other words, Bitcoin doesn’t replace the FI mindset—it completes it.

The Missed Opportunity

ChooseFI and Bitcoin share the same end goal: personal sovereignty, freedom from wage dependence, and the ability to live life on your own terms. But their tactics differ, mostly because of assumptions they make about the system.

- ChooseFI says: “Inflation exists, so invest wisely to beat it.”

- Bitcoin says: “Inflation exists because the money is broken—so let’s fix the money.”

Both strategies have value. But only one questions the foundation.

And here’s the deeper issue: too many in the ChooseFI world are afraid to deviate from the script. There’s a culture of “stay the course,” which, while helpful during market turbulence, often becomes a dogma that discourages curiosity. I’ve met people in the FI community who understand something feels off—whether it’s the Fed printing trillions or housing prices going vertical—but they suppress those questions because they fear sounding like conspiracy theorists or rocking the boat.

I want to say this clearly: it’s okay to ask questions. In fact, if you’re pursuing financial independence, you should be asking deeper questions—about the money, the system, and whether the rules we’ve been taught still make sense in a world that’s changing fast.

A Better Future: Combine the Philosophies

Imagine if ChooseFI thinkers began to see Bitcoin not as a speculative gamble, but as a form of saving that aligns with their most cherished values: delayed gratification, personal responsibility, and building a more secure future.

If these two groups came together, we’d have something powerful: a community that not only escapes the rat race—but understands why the race exists, who designed it, and how to stop participating in it altogether.

For ChooseFIers interested in Bitcion I’ll point you to a few of my previous articles below.

What Problem Does Bitcoin Solve? part 3 Buckminster Fuller, F.A Hayek & Henry Ford’s comments