Disclaimer – If you aren’t comfortable with all potential outcomes, including your Tesla shares dropping 50% in value, you shouldn’t consider this idea.

You also should not consider this if you are unfamiliar with trading options.

I am only sharing this to share information and educate.

I’ve been a Tesla shareholder for years, and I don’t plan to sell my core position anytime soon. But I’ve also been learning about covered calls as a way to generate income at a higher rate than today’s money market funds which currently are paying ~3.5% and going down as rates decrease!. Right now, I see the potential for about a 14% annual yield using this strategy — and I want to take advantage of that while keeping my long-term conviction in Tesla intact.

What’s a Covered Call?

A covered call is one of the simplest options strategies. It works like this:

- You own at least 100 shares of a stock. Most options are written where 1 option = a contract for 100 shares.

- You sell a call option to someone else, giving them the right (but not the obligation) to buy your shares at a set price (the strike price) by a certain date. For example – “You have the option to buy 100 shares of Tesla from me at $600 on or before 3-20-2026”

- You are paid a premium when you sell the option.

Two big things can happen:

- If the stock stays below the strike price, the option expires worthless. You keep both the shares and the premium.

- If the stock rises above the strike, you may have to sell your shares at that strike price. You still keep the premium, but you miss out on gains beyond that level.

Think of it like renting out your shares — you earn income while you hold them, but you’re capping your upside in exchange.

Why Tesla?

Tesla is currently trading around $440. My existing 400 shares make up about 12–13% of my overall portfolio (roughly $176k out of $1.4M). That’s a meaningful bet, but not my entire net worth. I personally have never looked at options before when I had less money. But I am considering it now with a very small part of my portfolio.

I’ve been holding Tesla for years and plan to continue. I believe in its long-term growth story, Elon Musk’s ability to deliver, and even the possibility of the company eventually reaching an $8 trillion valuation — nearly 6x its current $1.38 trillion market cap. That would potentially happen if Tesla hits all the growth targets in Elon’s proposed new pay package, that is voted on in November 2025. I have already voted yes and hope everyone else does also!

That conviction is what allows me to buy an extra 100 shares — not to hold forever, but to use specifically for covered calls.

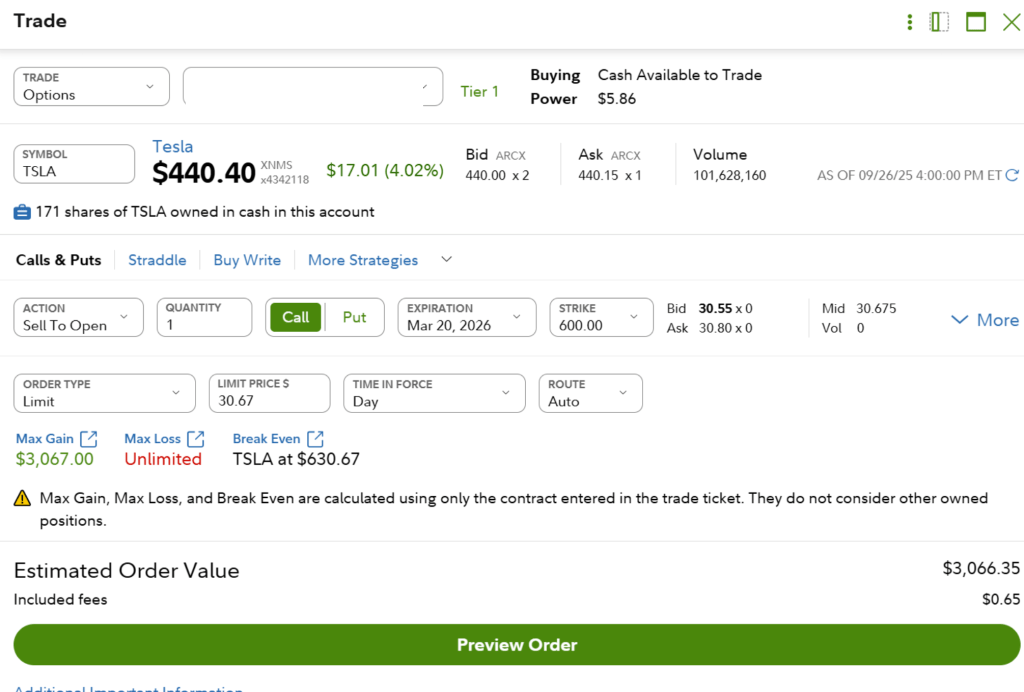

The Trade

- Underlying: Tesla at ~$440

- Shares purchased for strategy: 100 ($44,000)

- Option sold: $600 strike, expiring March 2026

- Premium collected: ~$30/share = $3,000

The Three Outcomes

Here’s how the trade plays out depending on Tesla’s price by March 20th, 2026:

| Scenario | Tesla Price | Outcome | Return |

| 1. Tesla < $440 | Falls below my purchase price | Shares drop in value, but I still keep the $3,000 premium. I’ll hold and sell another call in 6 months. | Paper loss on stock, but income cushions downside |

| 2. Tesla $440–$600 | Rises but stays under $600 | I keep both the shares and the $3,000 premium. | ~7% in 6 months (~14% annualized) + stock appreciation |

| 3. Tesla > $600 | Blows past $600 | Shares are called away at $600. I keep the $3,000 premium plus $16,000 in gains ($160/share). | ~$19,000 profit on $44,000 (~43% in 6 months) |

How This Fits My Long-Term Tesla Plan

Part of my long-term Tesla strategy for my original 400 shares has always been to gradually divest once it grows too large a percentage of my portfolio — say once it approaches 30–50%.

This covered call approach fits that plan perfectly: it generates income now and gives me a way to get paid while reducing exposure if Tesla keeps climbing.

- At $600/share, my portfolio would grow to about $1.5M, and Tesla would represent ~$300k of that (~20%). If 100 shares are called away, I’d reduce Tesla to 400 shares ($240k), which still leaves me with significant exposure.

- At $800/share, my portfolio could be around $1.6M. Selling another 100 shares would leave me with 300 shares worth $240k — still ~15% of my portfolio, almost the same weighting Tesla holds today (~12.6%). This is assuming the rest of my portfolio doesn’t also rise. It likely would so really Tesla would end up an even smaller percentage of my portfolio.

So even as I trim, Tesla stays a core but not outsized piece of my investments.

The Long-Term Upside

At $800/share, Tesla would be about a $2.5 trillion company. Even if I’m down to 300 shares at that point, that’s still $240k invested.

And if Tesla grows to an $8 trillion valuation as some expect — a 3.2x increase from $2.5T — my 300 shares could climb to about $768k.

That means even after trimming, I’d still capture massive upside if Tesla’s long-term growth story plays out.

Why This Works for Me

- It’s a small slice of my overall portfolio. At ~$44,000, the covered call sleeve is just 3% of my total assets. That makes it a safe experiment that doesn’t threaten my financial foundation.

- My core Tesla is protected. My long-term 400 shares are untouchable. The 100 new shares are my “income Tesla” — designed to work harder without risking my conviction stake.

- All three outcomes are acceptable. If Tesla dips, I’ll just sell another call. If it grinds sideways, I pocket income. If it rips higher, I still earn a great return, even if I give up some upside.

- It aligns with my long-term plan. Selling calls is a structured way to generate income and gradually reduce Tesla’s weight in my portfolio as it grows.

- Conviction makes it possible. I’m comfortable capping the upside on 100 shares because I still own 400 more shares that will fully benefit if Tesla continues to grow. This way, I get income from a small slice of my position, while my larger core holding remains positioned for the long-term upside.

Testing My Future Retirement Plan

This trade is also a trial run for my early retirement plan. If I eventually trim my Tesla position to around $240k (say 300 shares at $800), I could use the same covered call strategy to generate income.

At ~14% annualized, that $240k could potentially produce about $33k per year in income — without me ever touching the rest of my portfolio.

That’s a powerful idea: one high-conviction stock position, managed carefully with covered calls, could provide a meaningful cash flow stream in retirement while my index fund base continues to compound.

My Investing Context

Most of my portfolio is in index funds. That’s my base strategy — low-cost, diversified, and reliable.

But Tesla (and Bitcoin) are my two exceptions. I’ve listened to years of Tesla content, followed the company’s progress, and watched Elon Musk repeatedly deliver on ambitious goals. I believe in the growth story.

Final Thoughts

Covered calls aren’t “free money.” They limit your upside, and they only work if you’re comfortable with all possible outcomes. For me, splitting my Tesla into two buckets — 400 shares conviction hold, 100 shares income strategy — strikes the right balance.

Tesla remains my long-term hold. The extra 100 shares are simply there to spin off cash flow, provide income, and help me get paid while gradually divesting. That way, Tesla stays a meaningful but balanced piece of my portfolio — while still giving me the chance to benefit if Elon Musk delivers on the $8 trillion vision.

And looking ahead, this strategy doubles as a test run for retirement income — showing how one well-managed conviction position can help fund financial independence.

If you aren’t comfortable with all potential outcomes, including your Tesla shares dropping 50% in value, you shouldn’t consider this idea.

You also should not consider this if you are unfamiliar with trading options.

I am only sharing this to share information and educate.