The Fed has no power to stop government spending, which is the root cause of inflation!

Below is a quote from Senator Elizabeth Warren, during a grilling of Fed Chair Jerome Powell

Senator Warren: In other words, you don’t have a plan to stop a runaway train if it occurs. You know, Chair Powell, you are gambling with people’s lives. And there’s a pile of data showing the price gouging and supply chain kinks, and the war in Ukraine are driving up prices.

You cling to the idea that there’s only one solution: lay off millions of workers. We need a Fed that will fight for families. And if you’re not going to lead that charge, we need someone with the Fed who will. – original link here.

What does Senator Warren think he is going to do about price gouging and supply chain kinks, and the war in Ukraine?

The Federal Reserve literally has 1 tool in their tool box, and that is to raise rates. He can’t stop the war in Ukraine. He can’t fix supply chain kinks. While she has identified some things that are nominally impacting inflation, it’s not all of them. There is 1 big one she is missing, which she could impact as a Senator, Government Spending!

To be clear, what the Fed is trying to do is reduce spending by individuals so they aren’t buying so many things. They try to reduce spending by offering higher rates on bonds. The thought is that people will buy bonds paying 5% interest instead of spending their money on goods. The fewer people trying to buy goods, the less money is chasing the same amount of goods and the prices will go down.

Elizabeth Warren lives in her own kayfabe financial world. She is bullying the Fed Chair, Jerome Powell, to lower interest rates because she thinks he is hurting the economy. She is right that higher rates are one of the things that is likely to hurt the economy in the long run. But the real thing that is driving inflation in the USA is government spending. The US government debt is rising by $1 trillion about every 100 days.

Like I mentioned above, if the goal is to reduce spending in the economy by taking individuals’ money out of circulation by getting them to buy bonds, then the government comes in and is spending $1T, there isn’t less money chasing the same amount of goods, there is more money!

The Fed has no power to stop government spending, which is the root cause of inflation!

More money chasing the same amount of goods causes inflation. It is that simple.

Think of it as if you are at an auction and you have $100 in your wallet and 5 other people also have $100 in their wallets.. There is another bidder who has a printer who can literally print $100 bills at will and outbid you and all others at anything you want to buy. This bidder with unlimited buying power will bid up the price of things until they are beyond your reach. Are other bidders, who also all have $100 causing the problem? Or is the bidder with the money printing machine outbidding everyone causing the price of things at the auction to go higher?

It’s pretty clear in this situation that the money printer is driving prices higher. People don’t study fiscal policy (use of government spending and taxation to influence the economy) very often. Most people just want to work and then come home and live their lives. Because people don’t study it often, and it’s a pretty big and abstract thing to most people, it’s very hard to wrap their heads around.

There is also, unfortunately, almost nothing anyone can personally do to impact government spending.

I can only think of a few things you can do personally.

- Learn what is actually causing inflation instead of listening to the news tell you what they think is causing it.

- A couple of books I recommend to understand money and its role as a tool

- Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better – Lyn Alden

- Gold: The Once and Future Money – Nathan Lewis

- Principles of Economics – Saifedean Ammous

- Have a personally sound balance sheet. Spend less than you make. Invest your excess income in sound assets. Stocks, Real Estate, Gold, Bitcoin.

- Communicate with others about personal finances and government finances. If we all become more fiscally literate we might form a large enough coalition that we can start impacting government spending. But first we need to understand it ourselves. It is my hope that writing this and sharing it helps educate just 1 or 2 others about the topic.

- listen to this podcast – Prices, Interest Payments, & The US Deficit: It’s All Going To Get Worse with Greg Crennan

As an addendum to the above, I have copied the 2023 Congressional Budget Office report below, in case it disappears in the future. It highlights how the government spending is projected to grow as a percent of GDP every year going forward. Do we really want the government spending more and more of our money? Do we think a central authority is better at knowing what we need than we ourselves do? I think not.

I’ve also linked it below.

https://www.cbo.gov/publication/59014

Each year, the Congressional Budget Office publishes a report presenting its projections of what the federal budget and the economy would look like over the next 30 years if current laws generally remained unchanged. The long-term budget projections typically follow CBO’s 10-year baseline budget projections and then extend most of the concepts underlying them for an additional 20 years. This year, the long-term projections are based on CBO’s May 2023 baseline projections but also reflect the estimated budgetary effects of the Fiscal Responsibility Act of 2023 (Public Law 118-5), which was enacted on June 3, 2023.

Deficits

In CBO’s projections, the deficit equals 5.8 percent of gross domestic product (GDP) in 2023, declines to 5.0 percent by 2027, and then grows in every year, reaching 10.0 percent of GDP in 2053. Over the past century, that level has been exceeded only during World War II and the coronavirus pandemic. The increase in the total deficit results from faster growth in spending than in revenues. The primary deficit, which excludes interest costs, equals 3.3 percent of GDP in both 2023 and 2053, but the total deficit is boosted by rising interest costs.

Debt

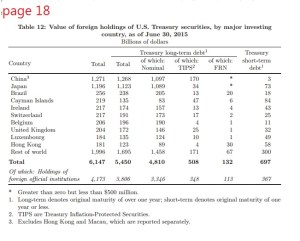

By the end of 2023, federal debt held by the public equals 98 percent of GDP. Debt then rises in relation to GDP: It surpasses its historical high in 2029, when it reaches 107 percent of GDP, and climbs to 181 percent of GDP by 2053. Such high and rising debt would slow economic growth, push up interest payments to foreign holders of U.S. debt, and pose significant risks to the fiscal and economic outlook; it could also cause lawmakers to feel more constrained in their policy choices.

Spending

In 2023, outlays fall to 24.2 percent of GDP as federal spending in response to the pandemic diminishes. Outlays continue to decline through 2026 but increase thereafter, reaching 29.1 percent of GDP in 2053. (By comparison, from 1993 to 2022, outlays averaged 21.0 percent of GDP.) Rising interest rates and persistently large primary deficits cause interest costs to almost triple in relation to GDP between 2023 and 2053. Spending on the major health care programs and Social Security—driven by the aging of the population and growing health care costs—also boosts federal outlays significantly over the next 30 years.

Revenues

Revenues fall to 18.4 percent of GDP in 2023 and continue to drop until 2026, when the scheduled expiration of certain provisions of the 2017 tax act causes tax receipts to increase. Revenues generally rise thereafter, reaching 19.1 percent of GDP in 2053, as an increasing share of income is pushed into higher tax brackets. (By comparison, from 1993 to 2022, revenues averaged 17.2 percent of GDP.)

Changes From Previous Projections

Measured as a percentage of GDP, federal debt is now projected to be 2 percentage points higher in 2023 and 9 percentage points lower in 2052 than it was in last year’s report. Overall, CBO’s projections of debt have increased through 2042 and decreased in later years.