Here’s an AI summary of the bitcoin presentaiton I’ve given 2x now and am set to give agian in the future. You can find the video here.

1. The Problem: Broken Money

- Money is supposed to store value from your labor, but inflation erodes that value over time.

- Fiat money used to be backed by gold until 1971; now it’s backed by government trust and military power (“money backed by bombs”).

- Governments print trillions, causing inflation and currency devaluation.

- Inflation isn’t caused by parties or policies — it’s caused by money printing.

- History (Roman Empire, etc.) shows debasing currency leads to collapse.

2. The Solution: Bitcoin

- Fixed supply: 21 million coins — no one can print more.

- Divisible: Each Bitcoin has 100 million satoshis (smallest unit).

- Scarcity = preserved value.

- Blockchain: Decentralized public ledger validating transactions without banks.

- Mining: Miners verify transactions, earn fees, and newly unlocked Bitcoin (currently 3.125 BTC every ~10 minutes).

3. Why Bitcoin Is Unique

- Fair launch: No pre-mine or early insider advantage; Satoshi mined alongside others.

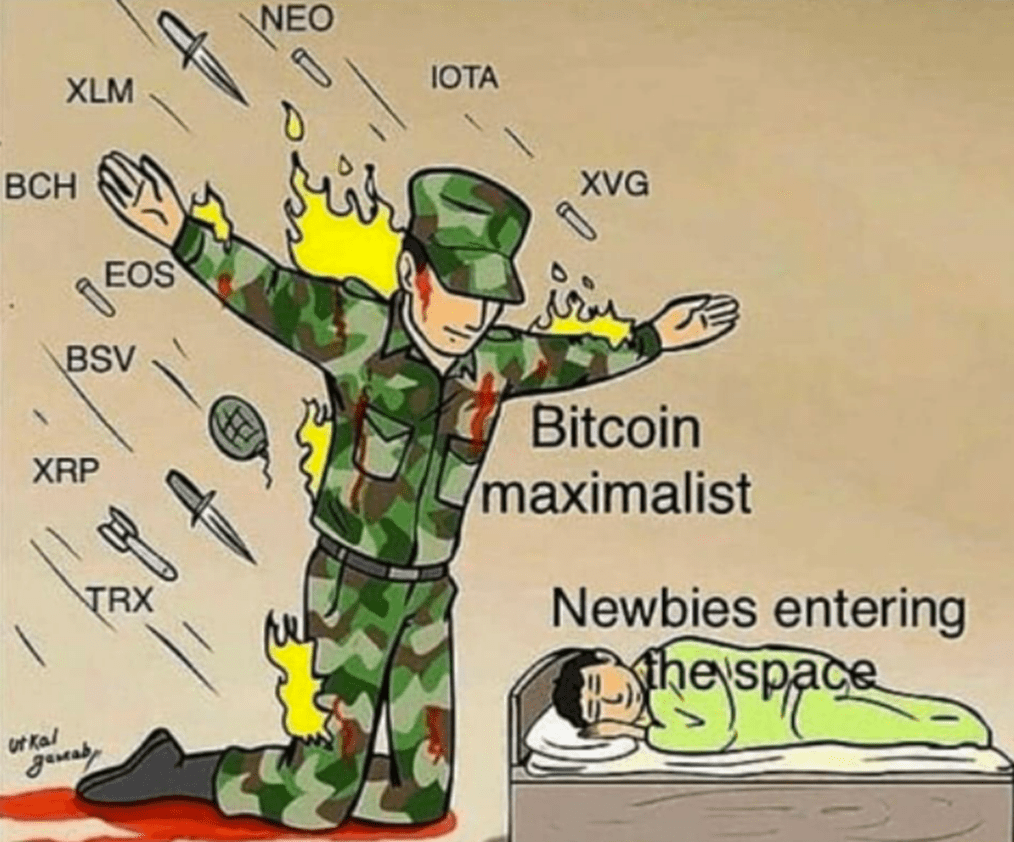

- Other coins (altcoins): Often pre-mined, centrally controlled, and solve fake problems — more like unregistered securities.

- Bitcoin solves one problem — store of value.

4. How to Buy Bitcoin

- Easiest: Through Bitcoin ETFs on Fidelity, Schwab (not Vanguard).

- Direct ownership: Strike, River, or Cash App (low fees, only Bitcoin).

- Avoid: Apps like Robinhood, PayPal, Coinbase — too many distracting altcoins.

5. Future Potential & Valuation

- Total global assets ≈ $750 trillion; “monetary premium” (store-of-value demand) ≈ $273 trillion.

- If Bitcoin absorbs that, price = ~$13 million per BTC.

- At $100,000 today, even small investments could have massive upside (e.g., $10k → $1.3M).

- Volatile, but long-term risk/reward is asymmetric.

6. Adoption Trends

- Governments adopting: El Salvador (legal tender), Bhutan, Pakistan, some U.S. states (Texas, NH, Arizona).

- Companies holding Bitcoin: Strategy (formerly MicroStrategy), Tesla, Block, Marathon, Coinbase, etc.

- U.S. forming a “Bitcoin strategic reserve.”

7. Final Takeaways

- Fiat money causes many global problems; Bitcoin fixes the root issue — sound money.

- Start small, invest what you can afford to lose.

- Learn more and grow your understanding — treat dips as opportunities.

- Key message: Broken money → broken world. Bitcoin → fixed money → potential for a better system.